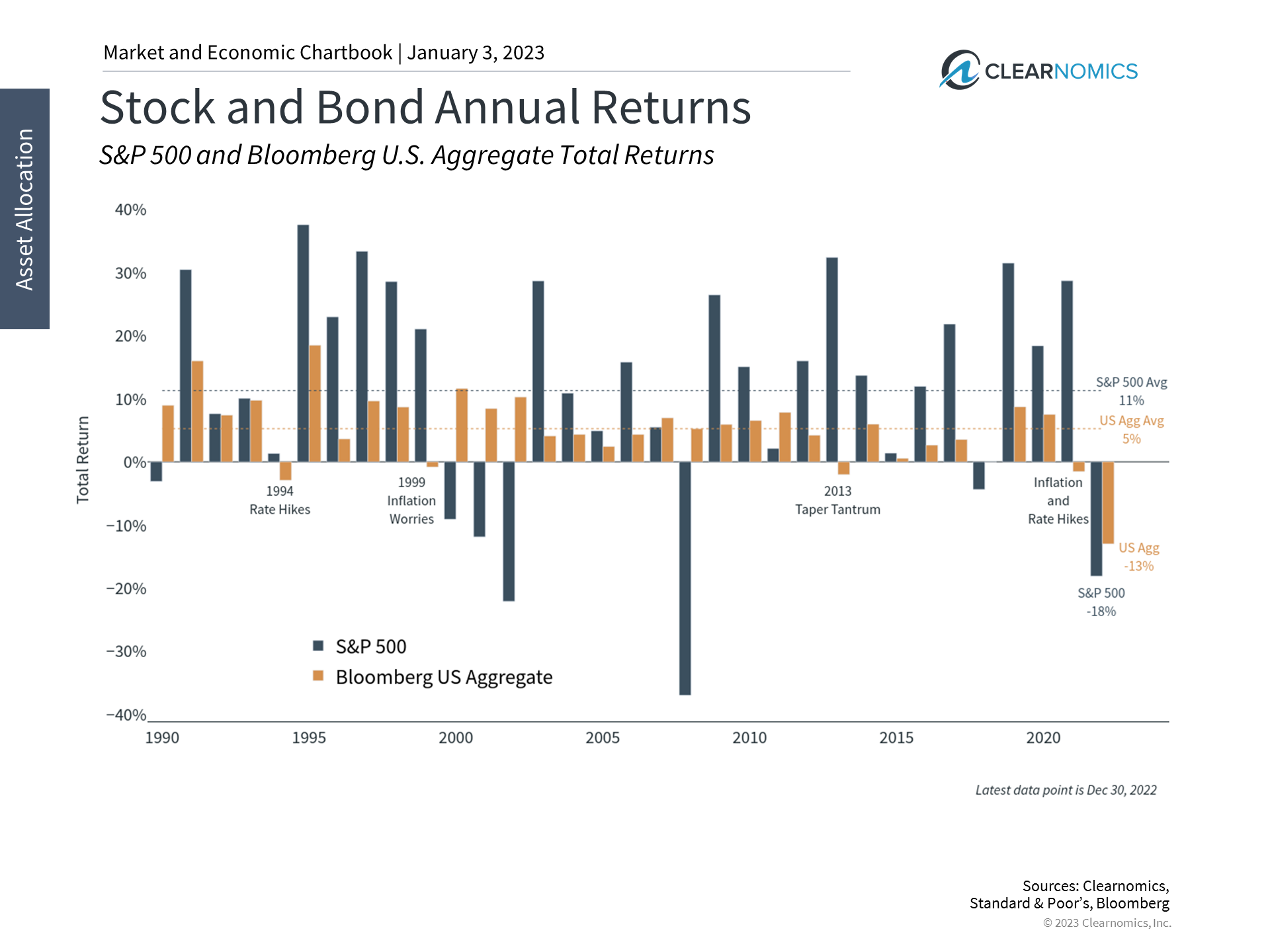

Beneath all of the headlines and day-to-day market noise, one key factor drove markets: the surge in interest rates broke their 40-year declining trend. Since the late 1980s, falling rates have helped to boost both stock and bond prices. Over the past year, the jump in inflation pushed nominal rates higher and forced the Fed to hike policy rates. This led to declines across asset classes at the same time.

While this has created challenges for diversification, there is also reason for optimism. Most inflation measures are showing signs of easing, even if they are still elevated. This has allowed interest rates to settle back down in recent months even as the Fed continues to hike rates. While still highly uncertain, most economists expect inflation and rates to stabilize over the next year rather than repeat the patterns of 2022.

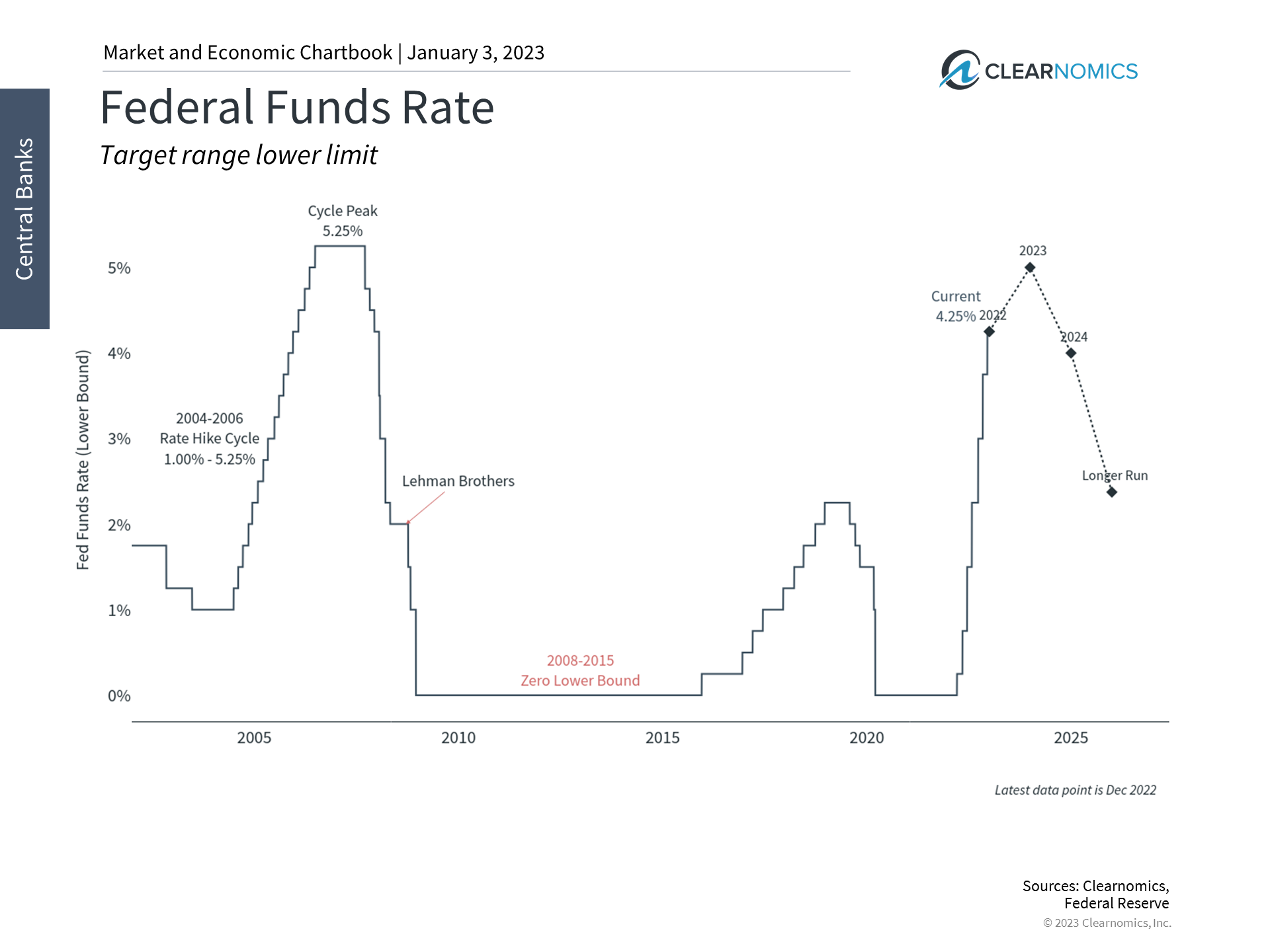

2. The Fed raised rates at a historically fast pace

Federal Funds Rate

Find this chart under “Global Central Banks”

The Fed hiked rates across seven consecutive meetings in 2022 including four 75 basis point hikes in a row. At a range of 4.25% to 4.50%, the fed funds rate is now the highest since the housing bubble prior to 2008. In its communication, the Fed has remained committed to raising rates further and keeping them higher for longer in order to fight inflation.

Current market-based measures suggest that the Fed could push policy rates to 5% by mid-2023. The central bank continues to face a balancing act between inflation and a possible recession. Despite two negative quarters of GDP growth in the first half of 2022, few consider the economy to be in recession already. Instead, some forecasters expect the U.S. and many other countries to experience a recession in 2023, although most also expect it to be shallow. Slowing growth may mean that the Fed takes its foot off the brake pedal sooner.

This is where the market arguably had unrealistic expectations last year. The market rally from June to August and again in October and November occurred when investors believed the Fed might begin loosening policy. When these hopes were dashed, markets promptly reversed, causing several back-and-forth swings over the course of the year. These episodes show that good news that is supported by data can be priced in quickly but that investors should not get ahead of themselves.

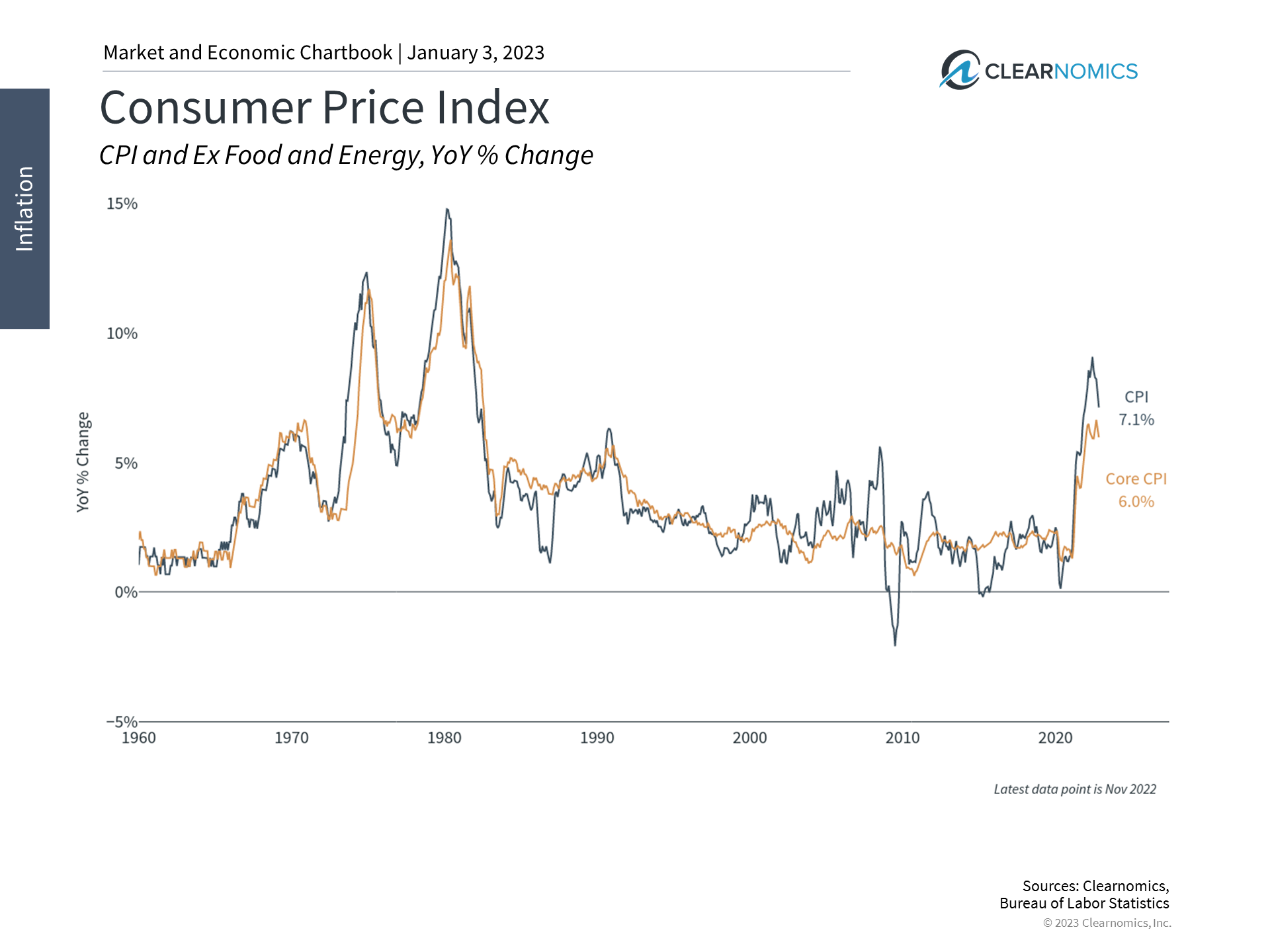

3. Inflation reached 40-year highs but has improved

Consumer Price Index

Find this chart under “Inflation”

While inflation has not been “transitory,” it may still be “episodic.” This is because the factors that drove these financial shocks were, for the most part, one-time events. Many of these are already fading as supply chains have improved, energy prices have fallen, and rents have eased. Still, the labor market remains extremely tight and wage pressures could fuel prices that remain higher for longer.

At this point, the direction of inflation may matter to markets more than the level. Investors have been eager to see signs of improvement across both headline and core inflation measures, and good news has been priced in rapidly. There are reasons to expect better inflation numbers over the course of 2023.

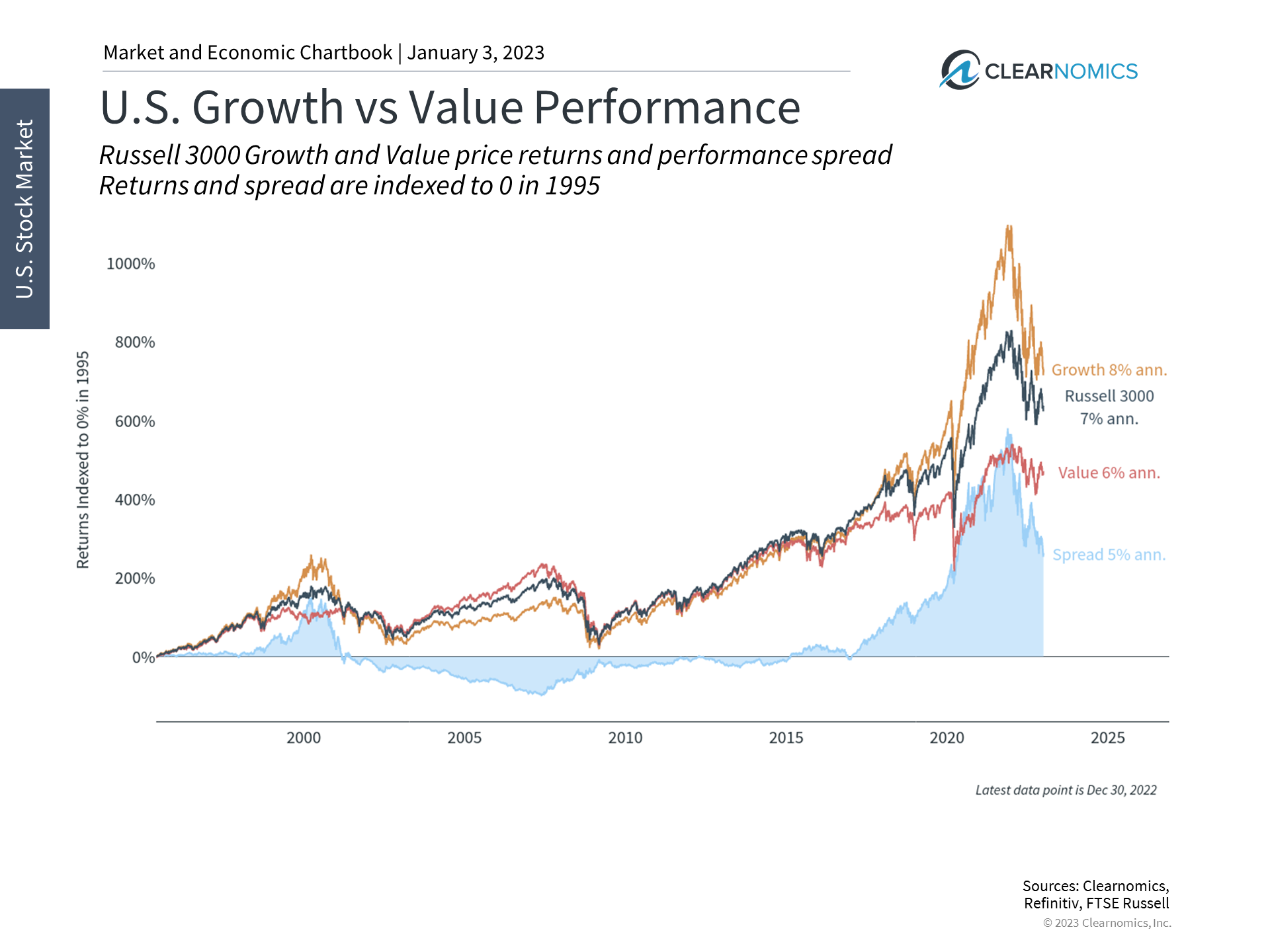

4. The rallies in tech, growth and pandemic-era stocks have reversed

U.S. Growth vs Value Performance

Find this chart under “Stock Market Factors and Styles”

The past year also experienced a reversal of the rallies in 2020 and 2021 that were concentrated in the tech sector, Growth style, and pandemic-era stocks. For the first time in years, Value outperformed Growth as former high-flying parts of the market crashed back to Earth as the economy slowed and interest rates jumped.

The key takeaway for investors is that diversifying across all parts of the market is important. This includes different size categories (large and small caps), styles (Value and Growth), geographies (U.S., developed markets and emerging markets), sectors, and more. It’s also a reminder that rallies can extend for long periods, during which investors experience FOMO and pile in with little thought to risk management. Staying disciplined during these periods, which occur periodically, is important to achieving long-term success.

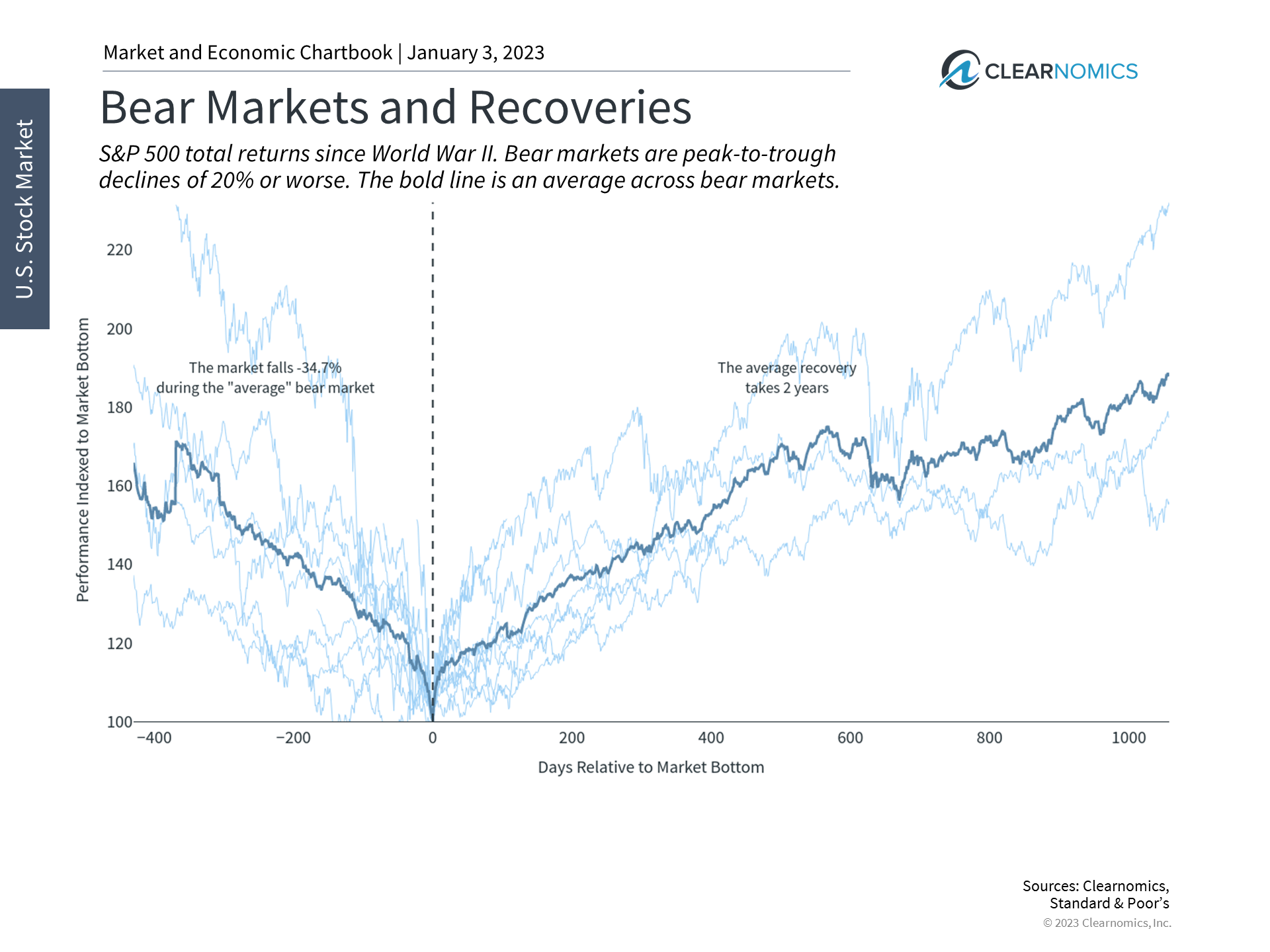

5. History shows that bear markets eventually recover when it’s least expected

Bear Markets and Recoveries

Find this chart under “Volatility and Staying Invested”

While 2022 was challenging, history shows that markets can turn around when investors least expect it. While it can take two years for the average bear market to fully recover, it’s difficult if not impossible to predict when the inflection point will occur.

Many investors have wished that they could go back to mid-2020 or 2008 and jumped back into the market. If research and history tell us anything, it’s that it’s better and easier to simply stay invested than to try to time the market. This could be true again in 2023, just as it was during previous bear market cycles.

The bottom line? While the past year was difficult, those investors who can stay disciplined, diversified and focused in the long run will be on a better path to achieving their financial goals in 2023 and beyond.