2023 marked an inflection point for markets with strong gains across both stocks and bonds. The S&P 500, Dow, and Nasdaq generated exceptional returns of 26.3%, 16.2%, and 44.7% with reinvested dividends last year, respectively. The S&P has come full circle and is now only a fraction of a percentage point below the all-time high from exactly two years ago. The U.S. 10-Year Treasury yield climbed as high as 5% in October before retreating to end the year around 3.9%, propelling bond prices higher. International stocks also performed well with developed markets returning 18.9% and emerging markets 10.3%.

2023 marked an inflection point for markets with strong gains across both stocks and bonds. The S&P 500, Dow, and Nasdaq generated exceptional returns of 26.3%, 16.2%, and 44.7% with reinvested dividends last year, respectively. The S&P has come full circle and is now only a fraction of a percentage point below the all-time high from exactly two years ago. The U.S. 10-Year Treasury yield climbed as high as 5% in October before retreating to end the year around 3.9%, propelling bond prices higher. International stocks also performed well with developed markets returning 18.9% and emerging markets 10.3%.

Perhaps the most important lesson of 2023 for investors is that news headlines and economic events don’t always impact markets as one might expect. Last year’s positive returns occurred despite historic challenges including the worst banking crisis since 2008, rapid Fed rate hikes, debt ceiling challenges and budget battles in Washington, the ongoing war in Ukraine, emerging Middle East conflicts, cracks in China’s economy, and much more. If you had shared these headlines with an investor at the start of 2023, one would probably have assumed there would be a worsening bear market and/or a deep recession.

Why isn’t this what happened? At the risk of oversimplifying, the key factor driving markets in the past few years has been inflation. High inflation affects all parts of the markets and economy including forcing the Fed to raise interest rates, slowing growth, hurting corporate profits, dampening consumer spending, and acting as a drag on bond returns. This is exactly what occurred in 2022 but many of these effects reversed in 2023 as inflation rates eased.

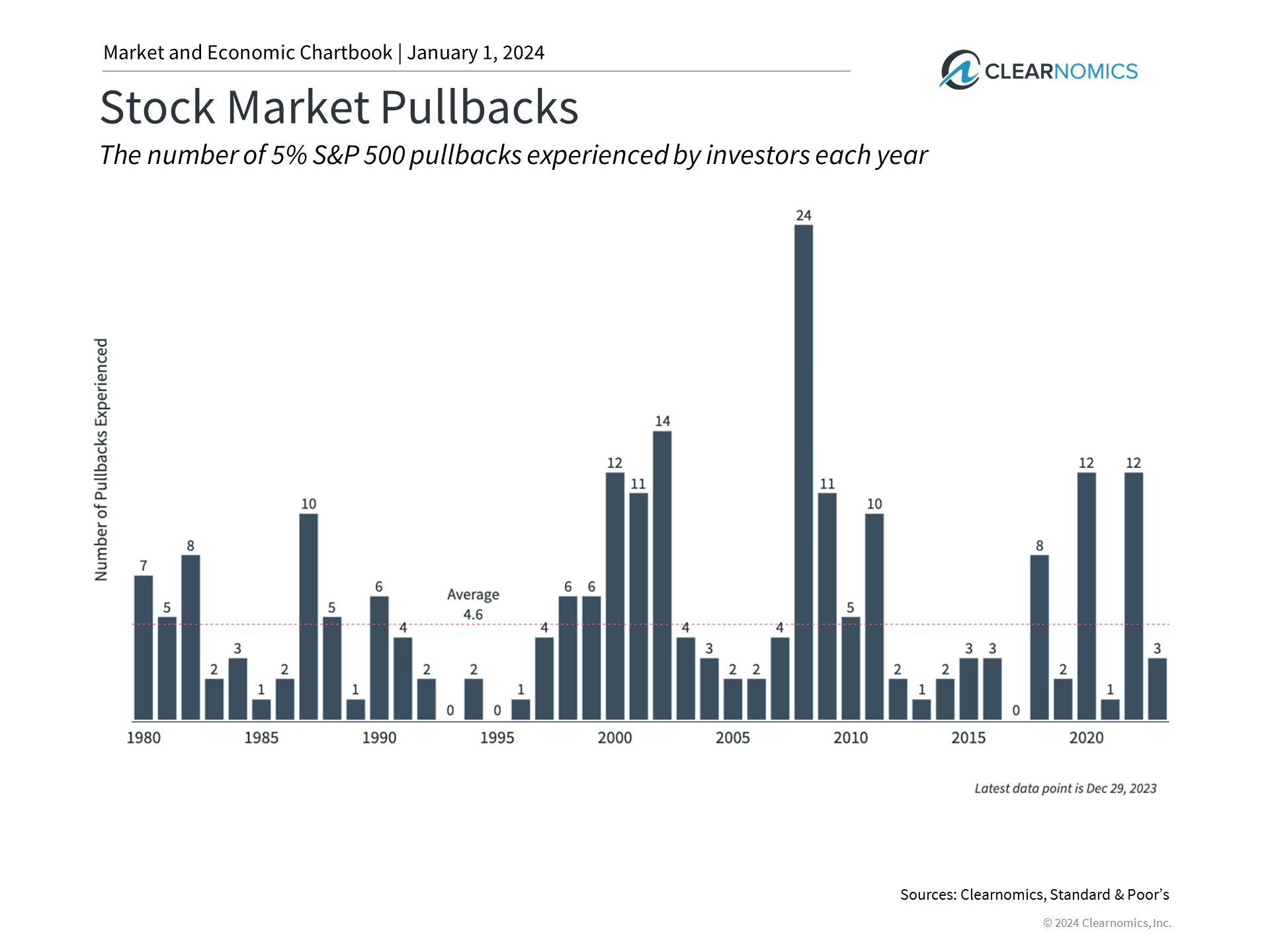

What does this mean for the year ahead? If 2022 was characterized by the worst inflation shock in 40 years, leading to a bear market in stocks and bonds, 2023 saw many of these factors reverse. These favorable trends might be sustained if the Fed begins to ease monetary policy. Near term, much is still uncertain, and investors should always expect the unexpected when it comes to market, economic, and geopolitical events. After all, markets never move up in a straight line and even the best years’ experience several short-term pullbacks.

The past year demonstrated the importance of remaining invested and diversified across all phases of the market cycle, rather than try to predict exactly what might happen on a daily, weekly, or monthly basis. Below are four key insights into the current market environment that will likely play important roles in 2024.

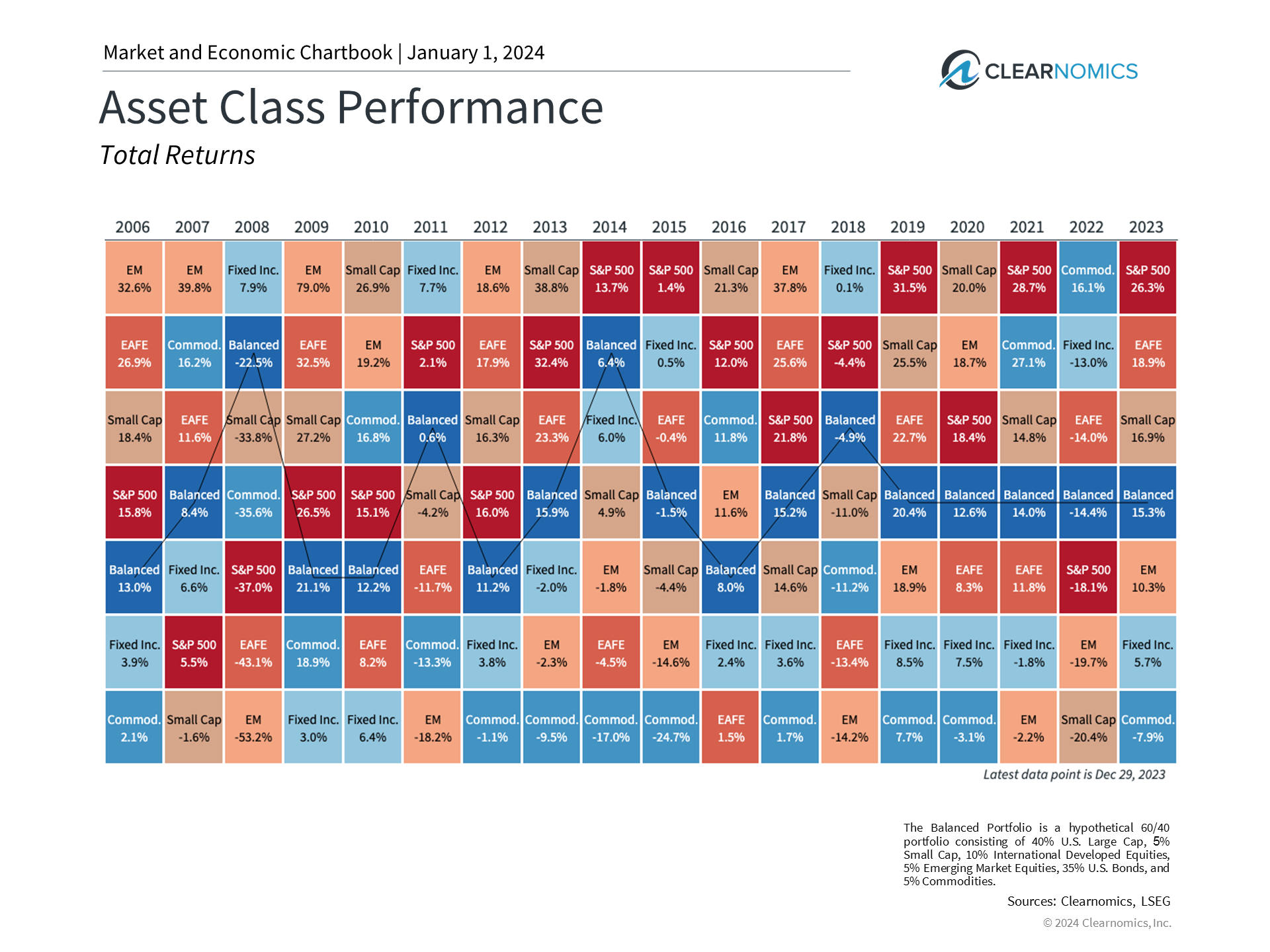

1. Many asset classes performed exceptionally well in 2023

Strong economic growth and falling interest rates later in the year propelled many asset classes higher. Stocks recouped much of their losses from the previous year with a historically strong gain and bonds bounced back as interest rates fell in the final months of the year. Technology stocks, especially those related to artificial intelligence, helped to drive market returns, pushing the Nasdaq to a nearly 45% return. While the so-called “Magnificent 7” (Apple, Microsoft, Meta, Nvidia, Broadcom, Netflix, and Tesla) doubled in value, other sectors and industries emerged as the year progressed.

Most importantly, there are signs that earnings growth is recovering. Earnings-per-share for the S&P 500 are expected to have been flat in 2023, but Wall Street consensus estimates suggest that they could grow by double digits each of the next two years. While this will depend on the path of economic growth, any increase in earnings will help to improve valuations and support the stock market.

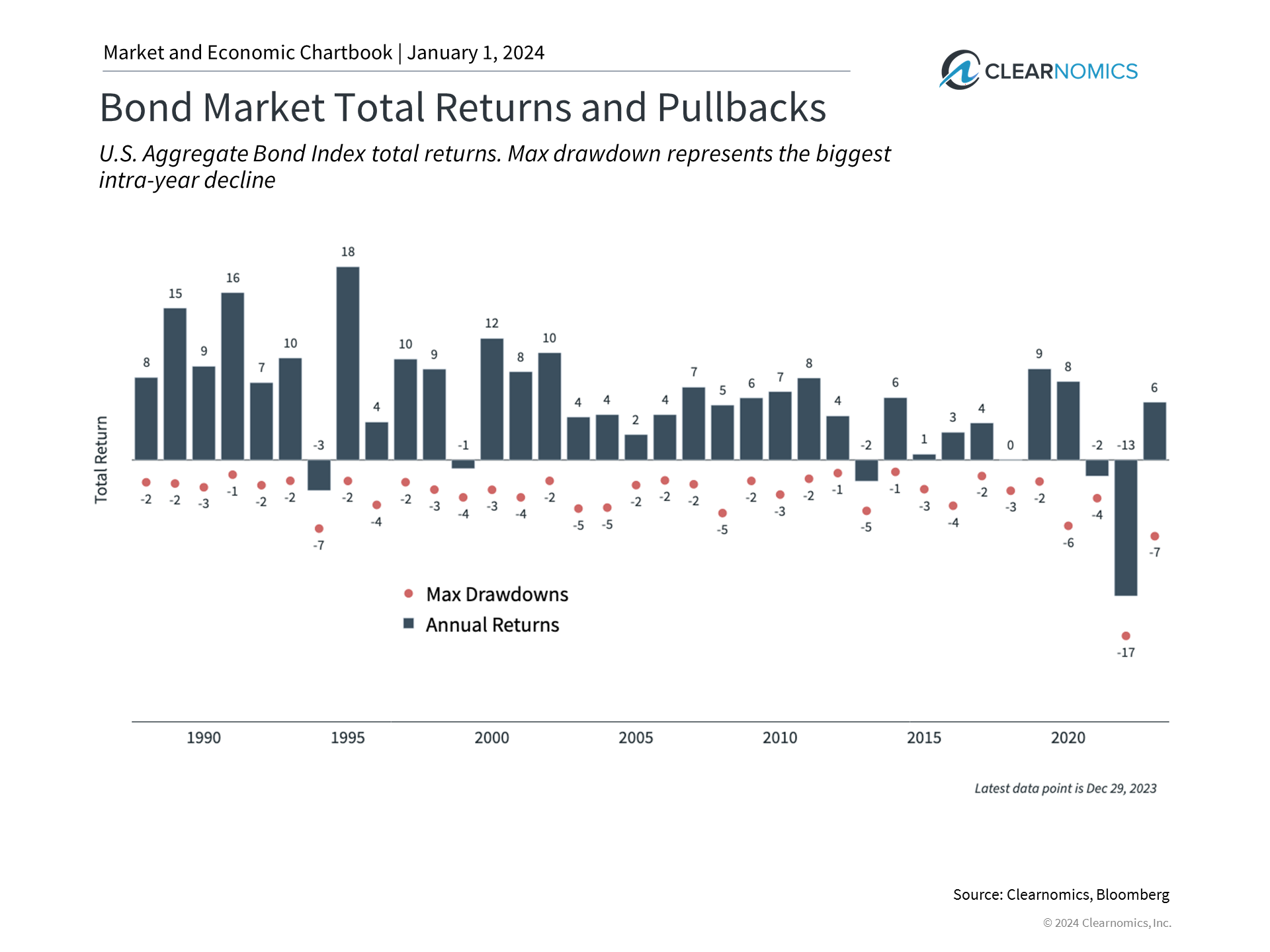

2. Bonds have rebounded as interest rates have stabilize

Bonds had a much better year with interest rates rising through October then falling on positive inflation data. While bonds have not recovered their 2022 losses after a historic spike in inflation, recent performance suggests that bonds are still an important asset class that can help to balance stocks in diversified portfolios. This is true across many sectors including high yield, investment grade, government bonds, and more.

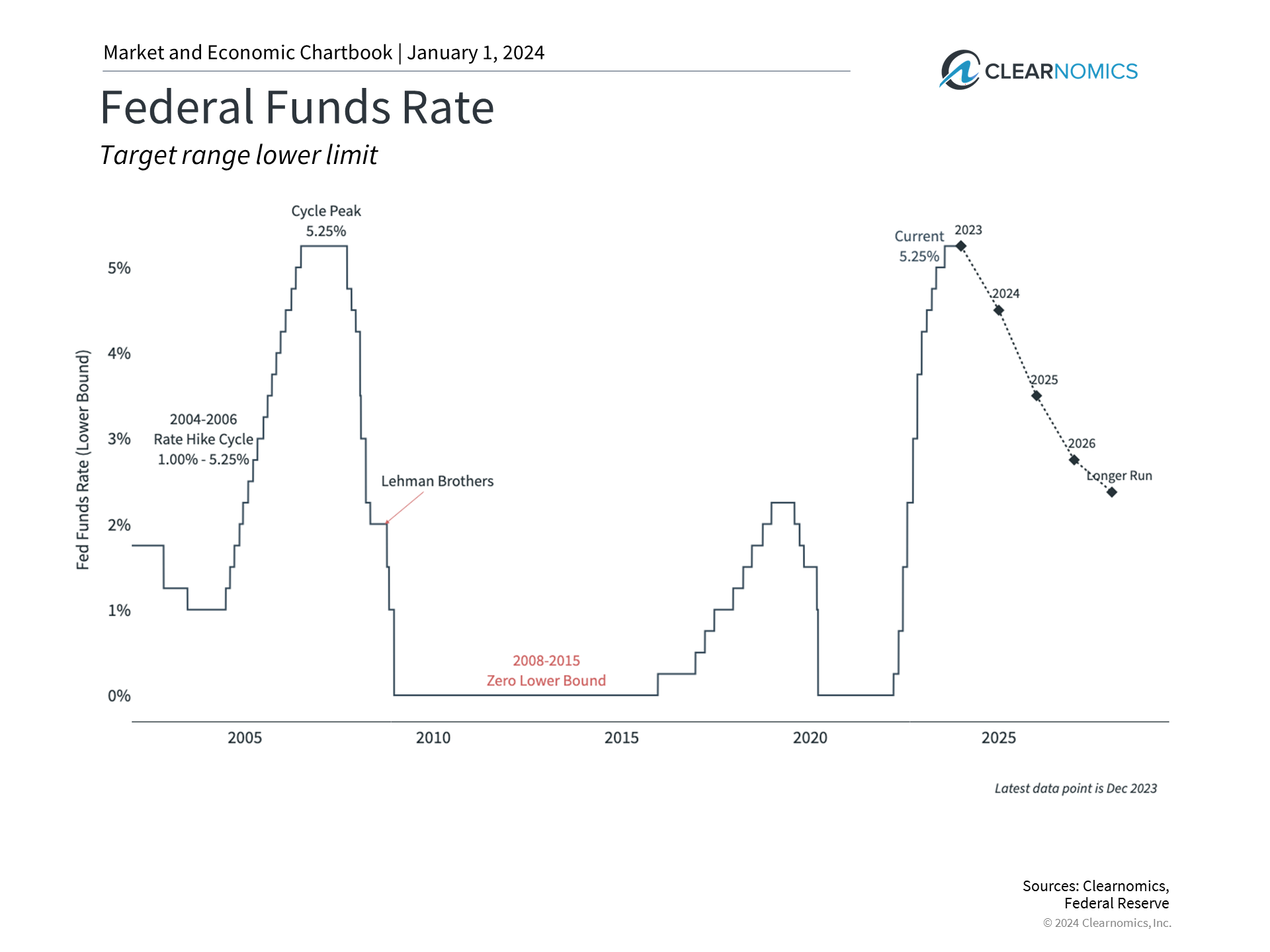

3. The Fed is expected to cut rates in 2024

Moderating rates of inflation coupled with a historically strong job market have assisted Fed efforts to achieve its policy objectives. While it’s too early to declare victory, many expect the Fed to begin cutting rates in 2024. The Fed’s own projections suggest they could lower rates by 75 basis points by the end of the year. Market-based expectations are much more aggressive and are expecting twice as many cuts. While it’s hard to predict exactly what the Fed may do this year, the fact that rates could begin to fall could help to support financial markets and the economy.

4. The most important lesson for investors is to stay invested

Bottom line: While the past twelve months have been positive for investment portfolios, investors should not become complacent. Volatility in the stock market is both normal and expected with even the best years experiencing short-term swings, as shown in the accompanying chart. Rather than trying to predict exactly when these pullbacks will occur, it’s more important for investors to hold diversified portfolios that are aligned with their financial goals and objectives. The past few years are a reminder that holding an appropriate portfolio and maintaining a consistent investment approach is what we think is the best way for investors to try to achieve their long-term financial goals.

Copyright (c) 2024 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company’s stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security–including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.

This presentation is not an offer or a solicitation to buy or sell securities. The information contained in this presentation has been compiled from third party sources and is believed to be reliable; however, its accuracy is not guaranteed and should not be relied upon in any way, whatsoever. This presentation may not be construed as investment advice and does not give investment recommendations. Any opinion included in this report constitutes our judgment as of the date of this report and are subject to change without notice.

Additional information, including management fees and expenses, is provided on our Form ADV Part 2, available upon request or at the SEC’s Investment Advisor Public Disclosure site. As with any investment strategy, there is potential for profit as well as the possibility of loss. We do not guarantee any minimum level of investment performance or the success of any portfolio or investment strategy. All investments involve risk (the amount of which may vary significantly) and investment recommendations will not always be profitable. Past performance is not a guarantee of future results.